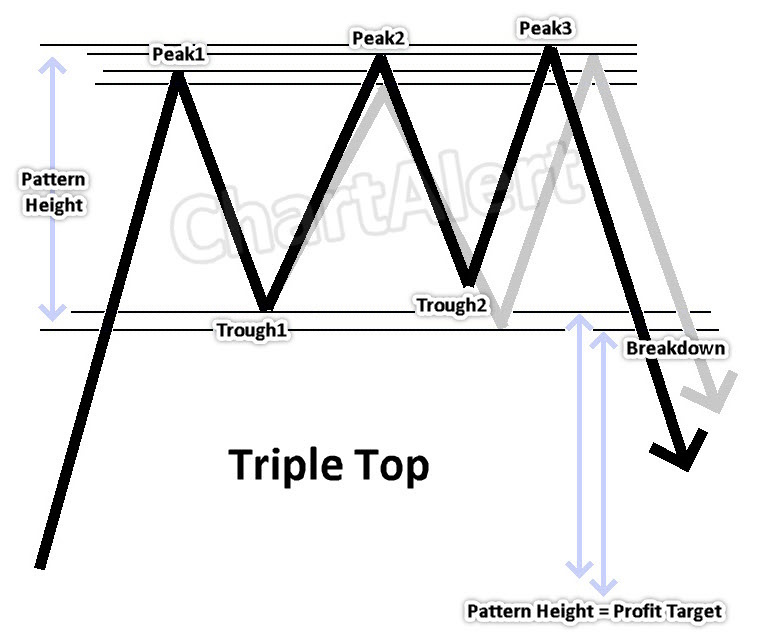

The Triple Top pattern is a strong bearish reversal signal in technical analysis. It forms when an asset’s price hits a resistance level three times, failing to break through and indicating a potential downtrend. Traders and investors can use this pattern to spot selling opportunities before a market decline.

Did you know ChartAlert can detect and scan for classical Chart Patterns? Click here to see how to use this feature in ChartAlert.

Understanding the Psychology Behind the Triple Top Chart Pattern

The Triple Top chart pattern is a well-known bearish reversal formation that signals a transition from an uptrend to a downtrend. It occurs when an asset’s price forms three peaks at roughly the same level, reflecting a weakening buying momentum and increasing bearish sentiment.

Key Phases of the Triple Top Pattern:

- Initial Uptrend: Before the pattern develops, the asset is in a strong uptrend fueled by positive market sentiment and buying pressure.

- First Peak and Pullback: As the price reaches a resistance level, profit-taking and selling pressure cause a decline.

- Second Peak and Decline: Buyers attempt another rally, but the price fails to break resistance. More traders recognize a possible reversal, leading to another drop.

- Third Peak and Reversal: A final attempt to breach resistance fails. The lack of new highs confirms weakening demand, prompting a sharp sell-off.

- Breakout and Confirmation: The price breaks below the support (neckline), triggering a strong downtrend as traders rush to exit long positions.

The Triple Top pattern reflects a shift in sentiment from bullish to bearish, as each failure to break resistance reinforces selling pressure.

Also see: Triple Bottom classical chart pattern

For customizable Triple Top classical chart pattern factory scans that can be edited, modified or revised, and subsequently scanned through ChartAlert’s native stock screener or technical analysis scanner, click here.

How to Trade the Triple Top Chart Pattern

Trading the Triple Top requires a disciplined approach to maximize profits and manage risk. Here’s a step-by-step guide:

1. Identify the Pattern

- Look for three clear peaks at a similar price level, with pullbacks in between.

- Draw a horizontal resistance line connecting the peaks and a neckline support line below the troughs.

2. Wait for Confirmation

- The pattern is confirmed when the price breaks below the neckline support level.

- Volume should increase on the breakdown, strengthening the bearish signal.

3. Entering a Trade

- Short entry: Initiate a short position when the price decisively breaks below the neckline.

- Conservative traders can wait for a retest of the neckline before entering.

4. Stop-Loss Placement

- Place a stop-loss slightly above the most recent peak to limit potential losses.

- If the price reclaims the resistance level, the pattern may be invalidated.

Also see: Stop Loss . . . and its importance in trading – Some ways of setting up stop loss levels

5. Profit Target and Exit Strategy

- Measure the height of the pattern (distance from peak to neckline) and project it downward to estimate the price target.

- Consider trailing stop-losses to lock in profits as the price moves lower.

Also see: Some ways of setting up take profit levels

6. Risk Management and Market Conditions

- Never risk more than a small percentage of your trading capital on a single trade.

- Monitor overall market trends and news events that could impact price movement.

Also see: How to determine one’s tolerance to risk?

7. Backtesting and Practice

- Before executing real trades, backtest the Triple Top pattern on historical data.

- Use a demo account to refine your entry and exit strategies.

How to Trade the Triple Top Chart Pattern

The Triple Top chart pattern is a powerful tool for traders looking to identify potential bearish reversals. However, it should be used in conjunction with other technical indicators and market analysis to improve accuracy. Risk management is key—no pattern guarantees success, and false breakouts can occur.

Ready to enhance your trading strategy? Try ChartAlert, our advanced technical analysis software, with a paid 4-week evaluation trial and take your trading to the next level. Sign up now!